In recent years, crypto ETFs have become one of the hottest topics in the financial world. Exchange-Traded Funds (ETFs) make it easier for regular people and institutions to invest in digital assets without directly holding them. The introduction of Bitcoin and Ethereum ETFs has already opened the door to wider adoption—and now, all eyes are on Spot Solana ETF.

A Spot Solana ETF would allow investors to gain exposure to SOL (Solana’s native token) by buying shares on traditional stock markets. Unlike futures-based ETFs, which track price indirectly, spot ETFs are backed by the actual asset.

This matters now more than ever, especially with recent ETF approvals, rising institutional interest, and Solana’s growing ecosystem. So, what are the real chances we’ll see a Spot Solana ETF approved soon? Let’s explore.

What Is a Spot Solana ETF?

ETF vs. Spot ETF

An ETF (Exchange-Traded Fund) is a financial product that tracks the value of an asset or group of assets and is traded on stock exchanges. Crypto ETFs can be:

- Futures-based: Track the price via futures contracts

- Spot-based: Directly backed by the actual cryptocurrency

A Spot Solana ETF would buy and hold real SOL tokens, making its performance directly tied to the current market price of Solana.

How a Spot Solana ETF Works

When investors buy shares of a Spot Solana ETF, the fund manager buys and stores SOL tokens in a secure wallet. This means investors don’t have to worry about private keys, wallets, or hacks—they just get exposure to the price.

Comparison to Bitcoin & Ethereum ETFs

Bitcoin and Ethereum ETFs have already gained traction. Their approvals set a regulatory precedent that may pave the way for Solana, especially if it can meet similar compliance and market readiness standards.

Current Status of Spot Solana ETF

As of mid-2025, several asset managers have shown interest in launching a Spot Solana ETF:

- VanEck recently filed an application with the SEC.

- 21Shares is rumored to be considering a SOL ETF, after its involvement in other crypto ETF projects.

SEC’s Position

So far, the U.S. Securities and Exchange Commission (SEC) has not approved any spot ETF for Solana. Its decisions often depend on whether the asset is considered a security or a commodity—a major point of debate for Solana.

Solana’s Legal Classification

The SEC has previously labeled some tokens as securities. While Solana is fast and scalable, it has faced scrutiny over its token distribution. This legal uncertainty could delay ETF approval.

Pro Tip: For updates on ETF filings and crypto regulation, check our Crypto Regulation News hub.

Factors That Influence ETF Approval

Several key elements can influence whether a Spot Solana ETF gets approved:

1. SEC’s Regulatory Stance

The SEC evaluates whether a product protects investors and if the market is resistant to manipulation.

2. Is Solana a Security or Commodity?

If Solana is classified as a security, it falls under stricter rules. Bitcoin and Ethereum were treated as commodities, which helped their ETFs get approved.

3. Market Maturity

The daily trading volume and liquidity of SOL are growing but still lag behind BTC and ETH. The more mature the market, the more likely the SEC will approve an ETF.

4. Institutional Interest

More hedge funds and asset managers are exploring Solana. This growing demand makes ETF approval more appealing to both regulators and issuers.

5. Bitcoin & Ethereum ETF Precedents

Their approvals show that it’s possible. But the SEC might wait to see how these ETFs perform before greenlighting others.

How Likely Is Approval in 2025 or Beyond?

Analyst Predictions

Many analysts suggest that if regulatory clarity around Solana improves, approval could happen within 12–24 months. However, it may come after Ethereum ETF performance is fully evaluated.

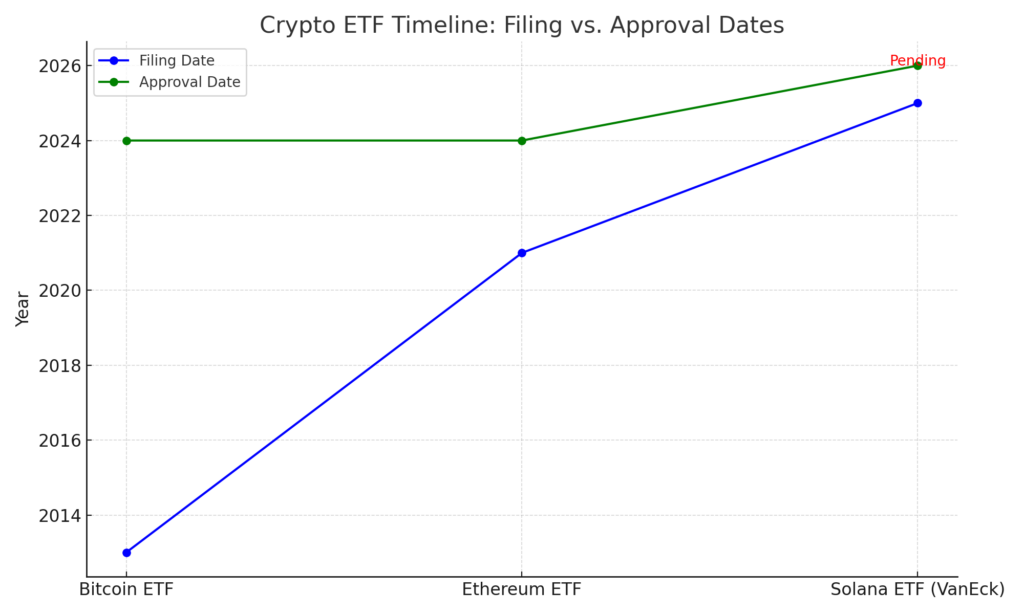

ETF Approval Timeline Example:

Here’s the visual comparing the ETF filing and approval timelines:

- Bitcoin ETF: Filed in 2013, approved in 2024

- Ethereum ETF: Filed in 2021, approved in 2024

- Solana ETF (VanEck): Filed in 2025, approval still pending (estimated for 2026 in the chart)

Key Challenges:

- SEC uncertainty over Solana’s legal status

- Market manipulation concerns

- Solana network outages in the past

Despite this, Solana’s speed, low fees, and expanding ecosystem make it a strong contender long term.

What Approval Could Mean for Solana

Price Impact

Like Bitcoin and Ethereum, SOL could see a sharp price increase after ETF approval due to fresh institutional demand.

Institutional Adoption

A regulated ETF gives traditional investors and funds a “safe” way to invest in Solana.

Legitimacy

Approval could signal that Solana is being accepted as a mature, investable asset.

Boost to Ecosystem

ETF interest often spills over into related sectors—NFTs, DeFi protocols, and dApps built on Solana could benefit too.

Want to learn more about DeFi on Solana? Check out our guide on Top Solana DApps in 2025

Risks and Concerns Around Spot Solana ETFs

Regulatory Pushback

Until Solana’s status is clearly defined, ETF approval remains uncertain.

Volatility

Solana is still more volatile than Bitcoin or Ethereum. That could scare off some institutional investors.

Centralization Risks

Critics point to validator concentration on the Solana network. If control lies in too few hands, regulators may hesitate.

Conclusion

So, what are the chances of a Spot Solana ETF being approved?

- The groundwork has started: applications are being filed.

- Solana is growing fast, but legal clarity is the biggest hurdle.

- 2025–2026 could be the window of opportunity, especially if Bitcoin and Ethereum ETFs perform well.

In the meantime, keep an eye on:

- SEC rulings

- Market liquidity

- New ETF filings

A Spot Solana ETF could be a game-changer, but like all crypto investments, it comes with risk.

FAQs

1. Has a Spot Solana ETF been approved yet?

No, as of now there are filings, but no official approval by the SEC.

2. How is a spot ETF different from a futures ETF?

A spot ETF is backed by the actual crypto (SOL), while a futures ETF uses contracts that track its price.

3. Will a Solana ETF boost the price?

Historically, ETF approvals have pushed prices up—but markets can be unpredictable.

4. Is investing in SOL before an ETF smart?

It depends on your risk tolerance and belief in Solana’s long-term future.

5. What are other ETF candidates?

Besides Solana, projects like XRP and Cardano are also being discussed as future ETF possibilities.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are volatile and carry risk. Always do your own research or consult a financial advisor before making investment decisions.

Need help picking a crypto wallet or staking SOL safely? Explore our Crypto Tools & Wallet Reviews for beginners and pros alike.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.