In 2024, Bitcoin USD stunned the world once again by breaking past the $70,000 mark, setting a new all-time high. This milestone reignited debates in the crypto world, with one big question on everyone’s mind: Will Bitcoin hit $200K by 2026?

The Bitcoin USD rate (BTC/USD) has seen dramatic swings over the years. From being worth just a few cents to reaching tens of thousands of dollars, Bitcoin’s rise has been nothing short of phenomenal. With institutional adoption growing and crypto regulations evolving, many believe Bitcoin could break new records.

In this article, we’ll explore Bitcoin’s journey, what influences the BTC/USD rate, expert predictions, key drivers, roadblocks, and whether hitting $200,000 is realistic or just hype. Whether you’re a crypto investor or just curious, this guide offers simple insights into one of the hottest financial questions today. Stay updated on the Bitcoin USD rate with real-time charts, expert forecasts, and market insights. See if BTC can reach $200K and what drives its price.

Bitcoin’s Journey Against the US

Bitcoin launched in 2009 with a value of practically zero. In the beginning, only tech enthusiasts and early adopters paid attention. But over time, interest—and price—grew rapidly.

Historical Timeline of Bitcoin Price Against the USD

| Year | Bitcoin Price (Approx.) |

|---|---|

| 2010 | $0.01 |

| 2013 | $100 |

| 2017 | $20,000 |

| 2020 | $10,000 |

| 2021 | $64,000 |

| 2024 | $70,000+ (New ATH) |

Several key events pushed Bitcoin upward:

- Halving Cycles: Every 4 years, Bitcoin’s block rewards get cut in half, reducing supply.

- Institutional Adoption: Tesla, MicroStrategy, and BlackRock showed growing interest.

- ETF Approvals: Spot Bitcoin ETFs in the U.S. made BTC more accessible to traditional investors.

Understanding the BTC/USD Rate

What Is the Bitcoin USD Rate?

The Bitcoin USD rate refers to how much one Bitcoin is worth in US Dollars. It’s the most widely watched crypto-to-fiat pair in the world.

Key Factors That Affect BTC/USD

- Supply & Demand

Bitcoin has a fixed supply of 21 million coins. As demand increases and supply slows (especially after halving), price tends to go up. - Market Sentiment

Positive news (e.g., ETF approvals, institutional buys) boosts demand. Bad news (hacks, bans) can cause panic selling. - Macroeconomic Trends

High inflation, low interest rates, or banking instability often push investors toward Bitcoin as a hedge. - USD Strength or Weakness

When the dollar weakens, assets like Bitcoin often rise in value relative to the USD. - US Monetary Policy

Fed decisions on interest rates and inflation control influence both the dollar and Bitcoin’s appeal.

converting bitcoin to cash

You can convert Bitcoin to cash by selling it through a cryptocurrency exchange, a peer‑to‑peer platform, or a Bitcoin ATM, depending on what is available in your area. The most common method is using a crypto exchange, where you transfer your Bitcoin to the exchange, sell it for fiat currency like USD or PHP, and then withdraw the funds to your linked bank account or e‑wallet. Peer‑to‑peer platforms allow you to sell directly to another person, often offering local payment options such as bank transfers or digital wallets, though you should use platforms with escrow services for safety. Bitcoin ATMs provide a faster but usually more expensive option, letting you sell Bitcoin and receive cash instantly. Before converting, consider transaction fees, withdrawal limits, processing time, and tax obligations, as these can vary by method and location.

how much is bitcoin worth?

Bitcoin’s current price is around $89,000–$92,000 USD (roughly ₱5.3–₱5.4 million PHP), though it fluctuates constantly across exchanges. Market movements, trading volume, and global news can quickly affect its value, so prices are always dynamic and may change within minutes.

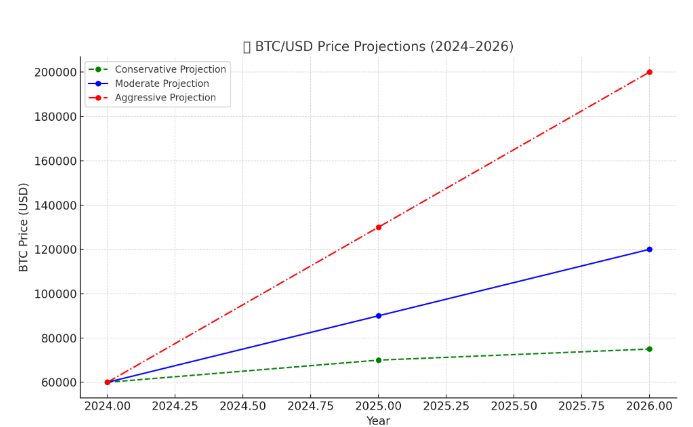

What Experts Are Predicting for 2026

Analysts and financial giants are divided—but many are optimistic about Bitcoin reaching six figures.

Bitcoin Price Forecasts by 2026

| Source | Predicted BTC Price |

|---|---|

| PlanB (Stock-to-Flow) | $250,000+ |

| Cathie Wood (ARK Invest) | $200,000+ |

| JPMorgan | $150,000 |

| Michael Saylor | “Eventually millions” |

While predictions vary, many agree on one thing: Bitcoin’s long-term trajectory is upward, especially if current adoption trends continue.

Key Drivers That Could Push Bitcoin to $200K

- Bitcoin Halving Cycle (2024)

History shows that Bitcoin usually surges within 12-18 months after a halving. This event cuts the number of new coins miners earn, making BTC scarcer. - Rising Institutional Investment

From hedge funds to pension funds, more institutions are entering the crypto market, adding billions in liquidity. - Global Economic Uncertainty

Economic crises, inflation, and distrust in fiat currencies often push people toward Bitcoin. - Mainstream Adoption & Clearer Regulations

As crypto becomes more regulated and user-friendly, more people are willing to invest. - De-dollarization Movement

Countries exploring alternatives to the USD as a reserve currency may use Bitcoin as a neutral asset.

Potential Roadblocks to Hitting $200K

It isn’t clear how strict or lenient regulations will be in different parts of the world. If institutions start to participate less and the market starts to lose faith, that could keep the price from reaching $200K. People may not want to invest in high-volatility assets like cryptocurrencies when macroeconomic challenges like high interest rates, tightening liquidity, or a global economic slowdown are happening.

Another problem is market dynamics. When long-term buyers and miners take profits at higher prices, it can lead to strong selling pressure. Also, technology risks, security issues, and loss of investor trust because of big hacks or failures in the crypto system could make things move slower and stop prices from growing steadily to the $200K mark.

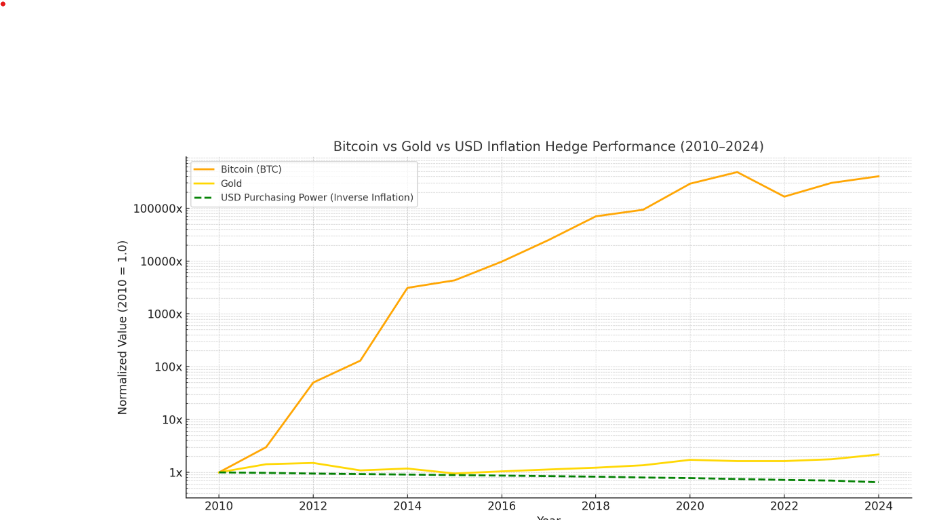

Bitcoin vs USD Inflation Hedge Performance

BTC/USD Price Projections (2024–2026)

How to Prepare If Bitcoin Hits $200K

If Bitcoin does reach $200K, what should investors do?

1. HODLing (Hold On for Dear Life)

Long-term holding can reduce emotional decision-making and timing mistakes.

2. Dollar-Cost Averaging (DCA)

Investing a set amount regularly helps smooth out volatility.

3. Risk Management

Only invest what you can afford to lose. Use cold wallets for long-term storage.

4. Diversify Your Crypto Portfolio

Don’t put everything in BTC. Consider Ethereum, Solana, or stablecoins for balance.

5. Use Trusted Platforms

Track real-time bitcoin usd rates on platforms like CoinMarketCap or CoinGecko. Trade only on regulated exchanges like Coinbase or Binance.

Conclusion: Is $200K Bitcoin a Fantasy or a Future Reality

While $200K may sound like a stretch, it’s not impossible. Bitcoin has already proven doubters wrong multiple times. If history, adoption, and macro trends continue, we may see a six-figure BTC within the next bull cycle.

However, it’s important to stay cautious. Crypto markets are unpredictable. Focus on solid strategies, keep learning, and never chase hype blindly.

FAQs

1. What is the highest BTC to USD rate ever recorded?

As of 2024, the all-time high is over $73,000.

2. Will the 2024 halving really impact the Bitcoin price?

Yes. Historically, prices have surged 12–18 months after each halving due to reduced supply.

3. Is Bitcoin a good hedge against USD inflation?

Many investors view Bitcoin as digital gold. It has outperformed inflation in recent years, but it also comes with high volatility.

4. How can I track live bitcoin usd rates?

You can monitor BTC/USD rates on trusted platforms like CoinMarketCap, Binance, or TradingView.

5. What risks should I consider before investing in BTC?

Volatility, regulatory changes, and cyber risks are the main concerns. Always do your own research and diversify.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investing involves risk, and prices can be highly volatile. Always consult with a financial advisor before making investment decisions.