Dollar Cost Averaging (DCA) is one of the simplest and most trusted investment strategies in crypto. Instead of trying to guess the perfect time to buy, DCA focuses on consistency. You invest a fixed amount of money at regular intervals, no matter what the market is doing. Crypto markets are known for sharp price swings. One day prices are up, the next day they crash. This volatility scares many beginners and often leads to emotional decisions. Dollar cost averaging helps remove that stress by creating a calm and steady approach to investing.

In this guide, you will learn what dollar cost averaging is, how it works in crypto, its benefits and risks, and how to use it correctly. By the end, you will understand how DCA can help minimize risk and maximize long-term crypto gains using simple and realistic steps.

What Is Dollar Cost Averaging?

Definition of Dollar Cost Averaging

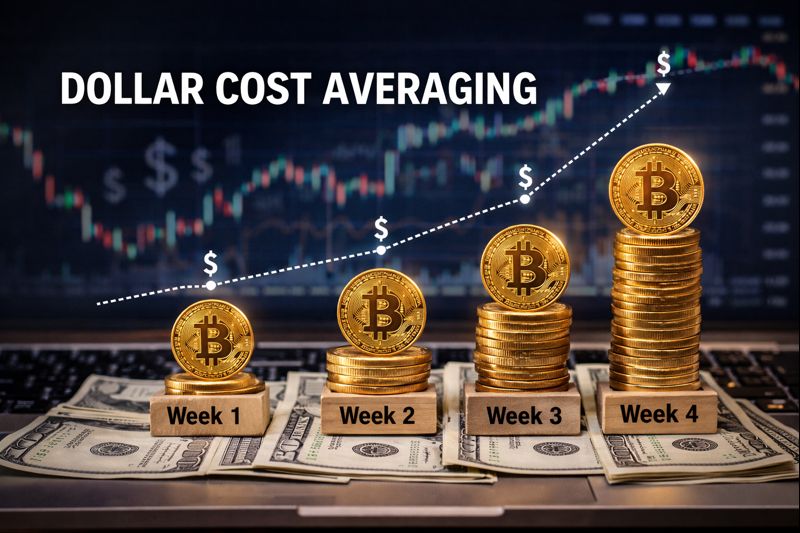

Dollar cost averaging is an investment strategy where you invest the same amount of money into an asset at regular intervals. These intervals can be daily, weekly, or monthly. The goal is not to time the market but to build a position over time.

For example, instead of investing $1,200 in Bitcoin at once, you invest $100 every month for 12 months.

How DCA Works in Simple Terms

When prices are high, your fixed amount buys fewer coins. When prices are low, the same amount buys more coins. Over time, this balances your average purchase price. This strategy removes emotions like fear and greed. You don’t panic buy during hype or panic sell during crashes. You simply follow your plan.

What is the dollar-cost averaging strategy in crypto?

The dollar-cost averaging (DCA) method is a way to invest in cryptocurrency in which you buy the same amount of cryptocurrency at regular times, no matter what the market price is. You don’t try to time the market; instead, you invest regularly, like once a week or once a month. This helps spread out your entry spots. You buy more coins when prices are low and less when prices are high. Over time, this lowers your average cost, lessens the effect of volatility, and keeps you from making hasty choices like buying or selling in a panic.

DCA vs Lump-Sum Investing

Lump-sum investing means investing all your money at once. While this can give higher returns during strong bull markets, it also carries higher risk if the market drops right after you buy. DCA spreads that risk over time. It may not always give the highest return, but it helps protect you from bad timing.

Why Dollar Cost Averaging Matters in Crypto

In the crypto market, Dollar Cost Averaging is important because the market is very changeable and hard to predict. Things can change quickly in terms of price, which makes it hard to know when to buy. DCA helps smooth out price changes by spending a set amount at regular times. This lowers the risk of buying at the wrong time. Emotional decisions, like buying in a panic during a hype or selling in a panic during a dip, are also taken away. Dollar cost averaging is a simple and disciplined way for both new and long-term investors to control risk while building a crypto portfolio slowly.

Key Benefits of Dollar Cost Averaging

Minimizes Timing Risk

No one can predict the perfect entry point. DCA removes the need to time the market, which is one of the hardest parts of investing.

Reduces Market Volatility Impact

Because you buy during both highs and lows, short-term price swings matter less. Your average cost becomes more stable over time.

Builds Disciplined Investing Habits

DCA creates consistency. You invest regularly, build patience, and avoid emotional decisions.

Works in All Market Conditions

Whether the market is bullish, bearish, or moving sideways, DCA continues to work. This makes it ideal for long-term crypto strategies.

Potential Drawbacks of Dollar Cost Averaging

It is safer and more disciplined to use dollar cost average, but it does have some problems. If you spread your investments out over time instead of spending all at once, you might miss out on early price increases, which can mean lower returns during strong bull markets. When you buy things a lot, especially on sites with high trading costs, the transaction fees may go up. Also, DCA isn’t good for short-term players who want to make money from quick changes in the market because it’s made for long-term growth, not quick gains.

How to Use Dollar Cost Averaging in Crypto

In order to use dollar cost averaging in crypto, you should first pick a strong and stable cryptocurrency with long-term potential, like Ethereum or Bitcoin. Finally, choose how often you want to invest based on your income and schedule. You can choose to invest daily, weekly, or monthly. Set a fixed amount that you can afford to spend every month, no matter what the market does, and stick to it. To stay disciplined and avoid making snap choices based on your feelings, you could use the automated DCA tools that many crypto exchanges and apps offer. These tools can handle your regular purchases without you having to keep an eye on them all the time.

Best Dollar Cost Averaging Strategies

DCA During Bear Markets

Bear markets offer lower prices. DCA allows you to accumulate more coins while others are fearful.

Long-Term DCA for Bitcoin and Ethereum

Bitcoin and Ethereum are the most common assets for DCA because of their long-term adoption and network strength.

Adjusting Based on Market Conditions

Some investors increase their DCA amount during deep market dips and reduce it during strong rallies.

Combining DCA with Diversification

You can DCA into multiple assets, but avoid spreading funds too thin early on.

Real-World Example of Dollar Cost Averaging

Sample DCA Scenario

Let’s say you invest $200 per month into Bitcoin for one year.

| Month | BTC Price | Amount Invested | BTC Bought |

|---|---|---|---|

| Jan | $40,000 | $200 | 0.005 BTC |

| Feb | $35,000 | $200 | 0.0057 BTC |

| Mar | $30,000 | $200 | 0.0066 BTC |

Over time, your average cost becomes lower than buying all at once.

Common Dollar Cost Averaging Mistakes to Avoid

Inconsistent Investing

Skipping months breaks the strategy. Consistency is key.

Ignoring Fees

Always check trading and withdrawal fees.

Over-Diversifying Too Early

Focus on strong assets before expanding into smaller coins.

Panic Stopping During Market Dips

Market crashes are part of crypto. Stopping DCA during dips defeats the purpose.

Who Should Use Dollar Cost Averaging?

- Beginners who want a simple strategy

- Risk-averse investors

- Long-term crypto believers

- Busy people who don’t watch charts daily

Is Dollar Cost Averaging a Good Strategy in 2026?

Crypto adoption continues to grow through ETFs, institutions, and real-world use cases. Volatility is still present, making DCA relevant. Experts agree that long-term disciplined strategies like DCA remain effective, especially for Bitcoin and Ethereum.

Final Thoughts

Dollar cost averaging is not about getting rich overnight. It’s about building wealth slowly and safely. It helps reduce risk, remove emotions, and create good investing habits. If you believe in the future of crypto, DCA is one of the best strategies to stay consistent and confident.

Frequently Asked Questions (FAQs)

1. Is dollar cost averaging profitable in crypto?

Yes, especially for long-term investors focused on strong assets.

2. How much should I invest using DCA?

Only what you can afford to lose. Even small amounts work.

3. Can I stop DCA anytime?

Yes, DCA is flexible and can be adjusted or stopped anytime.

4. Is DCA better than timing the market?

For most people, yes. Timing the market is very difficult.

5. Is DCA good for beginners?

Yes, it’s one of the safest strategies for beginners.

6. Can I DCA into altcoins?

Yes, but focus on strong and established projects.

7. How long should I DCA?

Ideally for years, not months.

8. Does DCA work in bear markets?

Yes, bear markets are often the best time for DCA.

9. Are there risks with DCA?

Yes, but risks are lower compared to lump-sum investing.

10. Should I automate my DCA?

Automation helps maintain discipline and consistency.

Disclaimer

This content is for educational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are highly volatile and risky. Always do your own research and consult with a financial advisor before making investment decisions.

This puzzle game is a fantastic brain teaser! With its simple yet challenging gameplay, cube to hole offers hours of engaging fun. If you love logic puzzles and strategic thinking, this is definitely worth checking out for a satisfying and rewarding experience.

If you’re a fan of rhythm games with a quirky twist, you’ll love this! The vibrant visuals and catchy tunes make fnf cartoon funkin vs wander over yonder a blast. It’s a fun challenge that’s easy to pick up but offers plenty of replayability for those aiming for perfect scores. Definitely worth checking out!