What Makes 5starsstocks.com Stocks Different

In a sea of investment platforms promising market-beating returns, 5starsstocks.com Stocks stands apart with its data-driven approach to stock analysis. Launched in 2023, the platform was designed to bridge the gap between complex financial data and actionable investment insights. Unlike traditional stock picking methods that often rely heavily on manual research or broker recommendations, 5starsstocks.com employs advanced algorithms to identify potential opportunities across multiple market sectors.

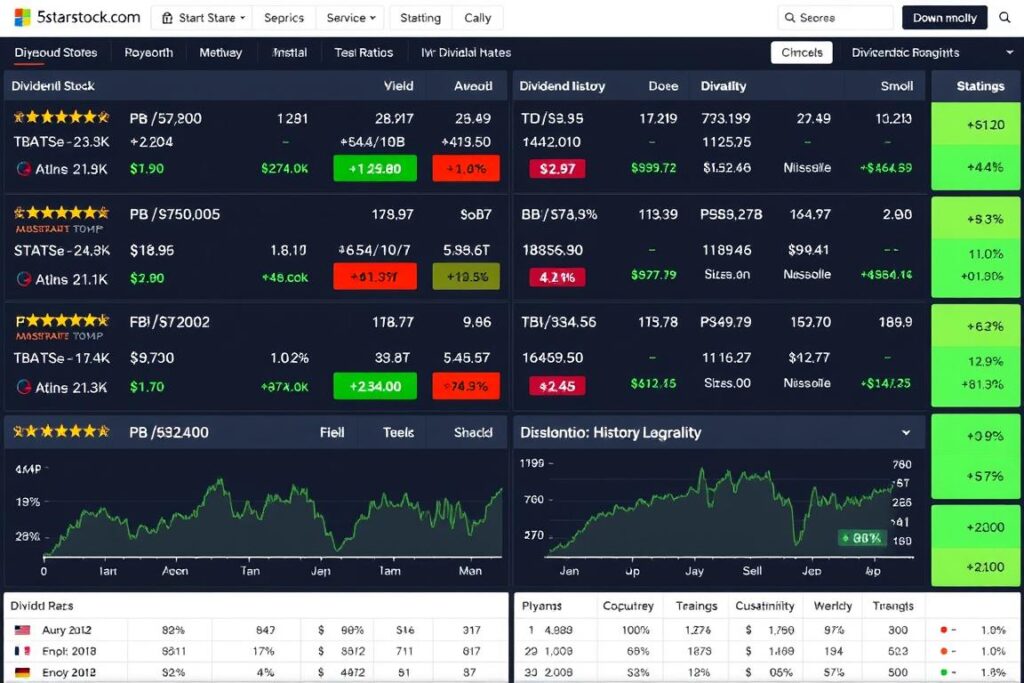

The 5starsstocks.com Stocks dashboard provides an intuitive interface for analyzing potential investments

The platform’s approach resonates with today’s investors who need to make informed decisions quickly in fast-moving markets. Whether you’re researching AI stocks, dividend opportunities, or defense sector investments, the system streamlines the evaluation process through its unique rating methodology and sector-specific insights.

Innovative Features of 5starsstocks.com Stocks

Five-Star Rating System

At the core of the platform is its proprietary five-star rating system that evaluates stocks based on multiple factors including performance history, growth potential, market stability, and risk assessment. This intuitive approach simplifies complex data into an easily digestible format:

| Rating | Description | Recommendation |

| ★★★★★ (5 Stars) | Premium stocks with strong fundamentals, consistent growth, and minimal risk | Strong Buy |

| ★★★★☆ (4 Stars) | Solid investments with good growth potential and manageable risk | Buy |

| ★★★☆☆ (3 Stars) | Moderate opportunities with average growth prospects | Hold/Watch |

| ★★☆☆☆ (2 Stars) | Higher risk investments requiring careful consideration | Cautious Approach |

| ★☆☆☆☆ (1 Star) | High-risk or declining stocks with significant concerns | Avoid |

AI-Driven Market Intelligence

5starsstocks.com Stocks leverages artificial intelligence to analyze vast amounts of market data, identifying patterns and trends that human analysts might miss. The platform continuously monitors news articles, social media discussions, and analyst opinions to gauge market sentiment and spot emerging opportunities before they become mainstream.

The platform’s AI algorithms identify patterns and potential market movements

Interactive Stock Heat Map

One of the most visually intuitive features is the Interactive Stock Heat Map, which provides a color-coded visualization of market sectors and individual stocks. This tool allows traders to quickly identify hot sectors, spot outliers, and recognize potential opportunities at a glance – a significant improvement over traditional stock screeners.

Smart Alerts System

Unlike basic price alerts offered by most platforms, 5starsstocks.com’s Smart Alerts System monitors multiple factors simultaneously. It can trigger notifications based on unusual volume patterns, insider activity changes, or sudden shifts in market sentiment – giving traders a crucial time advantage in volatile markets.

How 5starsstocks.com Stocks Compares to Traditional Methods

Traditional Stock Picking

- Relies heavily on quarterly reports and historical data

- Often requires hours of manual research per stock

- Typically focuses on familiar companies and sectors

- Analysis can be influenced by personal bias

- Limited capacity to process multiple data sources

5starsstocks.com Approach

- Incorporates real-time data and predictive analytics

- Automates research across hundreds of stocks simultaneously

- Discovers opportunities across diverse market sectors

- Uses objective algorithms to reduce emotional decision-making

- Processes news, social sentiment, and technical indicators together

The platform’s approach represents a significant evolution from traditional methods that often rely on quarterly earnings reports, broker recommendations, or time-consuming manual research. By automating much of the analytical heavy lifting, 5starsstocks.com Stocks allows traders to focus on strategy and execution rather than data gathering.

Traditional research methods vs. 5starsstocks.com’s streamlined approach

Real-World Applications: How Traders Use 5starsstocks.com Stocks

Case Study 1: The Dividend Income Investor

Sarah, a 45-year-old professional focused on building passive income streams, was spending 5-6 hours weekly researching dividend stocks. After discovering 5starsstocks.com Stocks, she utilized the platform’s dividend stock filters and rating system to identify overlooked opportunities with sustainable payout ratios and growth potential.

Sarah’s Strategy with 5starsstocks.com:

- Filter for stocks with 4+ star ratings in the dividend category

- Verify dividend growth history using the platform’s historical data

- Set Smart Alerts for dividend announcement dates

- Build a diversified portfolio across multiple sectors

Result: Sarah constructed a dividend portfolio yielding 4.7% annually while reducing her research time by 70%.

5starsstocks.com’s dividend stock analysis tools helped Sarah identify sustainable income opportunities

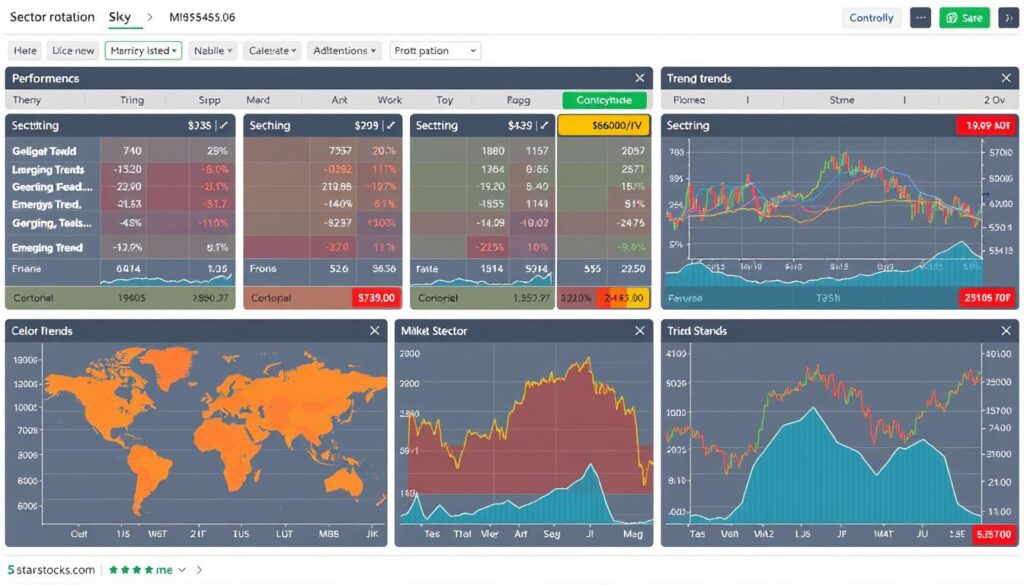

Case Study 2: The Sector Rotation Trader

Michael, an active trader looking to capitalize on sector rotations, struggled to identify emerging trends early enough. Using 5starsstocks.com’s Interactive Stock Heat Map and sector analysis tools, he developed a system to spot sectors gaining momentum before major price movements occurred.

Michael’s Approach:

- Monitor sector performance using the heat map visualization

- Identify sectors showing unusual strength or weakness

- Drill down to find the highest-rated stocks within emerging sectors

- Use Smart Alerts to track volume surges in target sectors

Result: Michael identified the AI sector’s momentum two weeks before a major rally, positioning his portfolio ahead of the trend.

The platform’s sector analysis tools helped Michael identify emerging trends before they became mainstream

Advantages and Limitations of 5starsstocks.com Stocks

Advantages

- Intuitive rating system simplifies complex stock analysis

- AI-powered insights identify opportunities human analysis might miss

- Comprehensive sector coverage across multiple industries

- Time-saving research automation for busy investors

- Smart Alerts provide actionable notifications beyond basic price alerts

- User-friendly interface accessible to investors of all experience levels

Limitations

- Relatively new platform with limited historical track record

- Some users report occasional overly optimistic ratings

- Limited transparency regarding specific algorithmic methodologies

- Primarily focused on US markets with less international coverage

- Best used as a supplementary tool rather than sole decision basis

- Premium features may require subscription costs

While 5starsstocks.com Stocks offers significant advantages through its innovative approach, prudent investors should recognize its limitations. The platform works best when used as part of a comprehensive investment strategy rather than as a standalone solution. As with any investment tool, combining its insights with additional research and personal due diligence yields the best results.

For optimal results, investors should use 5starsstocks.com as part of a broader research strategy

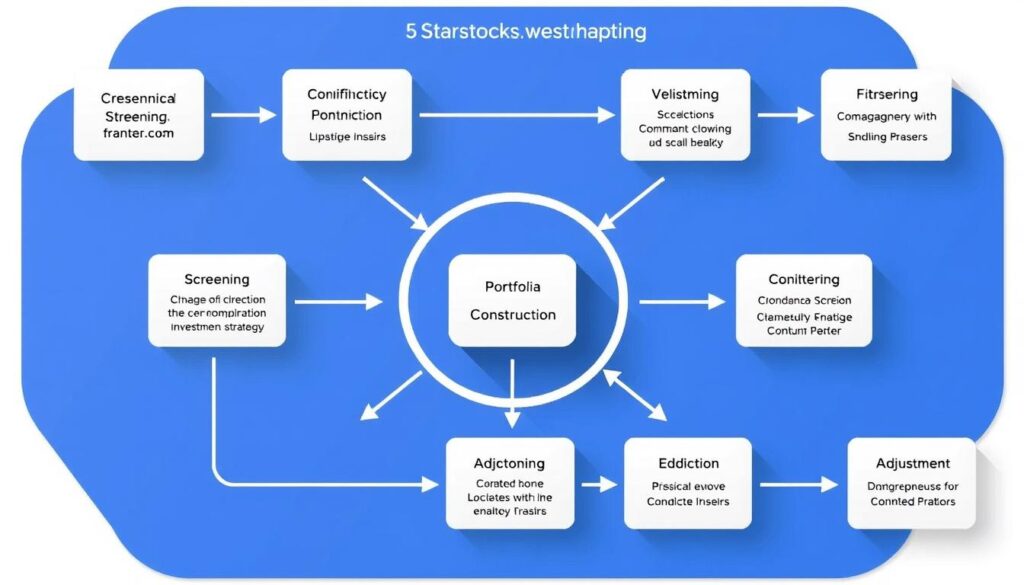

How to Integrate 5starsstocks.com Stocks Into Your Trading Strategy

To maximize the benefits of 5starsstocks.com Stocks while mitigating potential limitations, consider these practical implementation strategies:

For Beginners

- Start with the platform’s educational resources

- Focus on 5-star rated blue-chip stocks initially

- Use the sector analysis to understand market structure

- Practice with paper trading before committing capital

- Cross-reference ratings with established sources

For Active Traders

- Utilize Smart Alerts for timing entry/exit points

- Combine heat map data with technical analysis

- Focus on 4-5 star stocks showing unusual volume

- Set up custom watchlists by sector

- Use the platform to discover new trading opportunities

For Long-Term Investors

- Prioritize dividend and blue-chip stock sections

- Create a diversified portfolio across multiple sectors

- Set quarterly review reminders for portfolio assessment

- Focus on stocks maintaining consistent 4-5 star ratings

- Use as a screening tool for further fundamental analysis

A strategic approach to incorporating 5starsstocks.com into your investment workflow

Best Practices for All Users

- Verify with Multiple Sources: Cross-check 5starsstocks.com ratings with established platforms like Morningstar or Zacks

- Start Small: Begin with a small portion of your portfolio until you’re comfortable with the platform’s recommendations

- Set Clear Rules: Establish personal criteria for when to act on the platform’s insights

- Track Performance: Keep records of investments made based on platform recommendations to evaluate effectiveness

- Continuous Learning: Utilize the educational resources to enhance your understanding of the platform’s methodology

Pro Tip: The most successful users of 5starsstocks.com Stocks report using the platform as an idea generator and initial screening tool, followed by their own due diligence before making investment decisions.

Specialized Sector Coverage on 5starsstocks.com Stocks

One of the platform’s strengths is its comprehensive coverage across diverse market sectors. Each sector analysis includes specialized metrics relevant to that industry:

The platform provides specialized analysis tailored to each market sector

| Sector | Specialized Metrics | Key Advantages |

| AI Stocks | R&D investment ratio, patent analysis, market adoption rates | Early identification of emerging AI leaders and technology adoption trends |

| Dividend Stocks | Payout ratio sustainability, dividend growth history, yield stability | Focuses on dividend sustainability rather than just current yield |

| Defense | Government contract analysis, geopolitical risk assessment | Correlates defense spending trends with stock performance potential |

| Healthcare | Clinical trial progress, regulatory approval probability | Evaluates both established healthcare and emerging biotech opportunities |

| Energy | Production efficiency, reserves valuation, renewable transition metrics | Balanced analysis of traditional and renewable energy investments |

This sector-specific approach allows investors to dive deep into industries they’re familiar with or explore new sectors with the guidance of specialized metrics and analysis tailored to each industry’s unique characteristics.

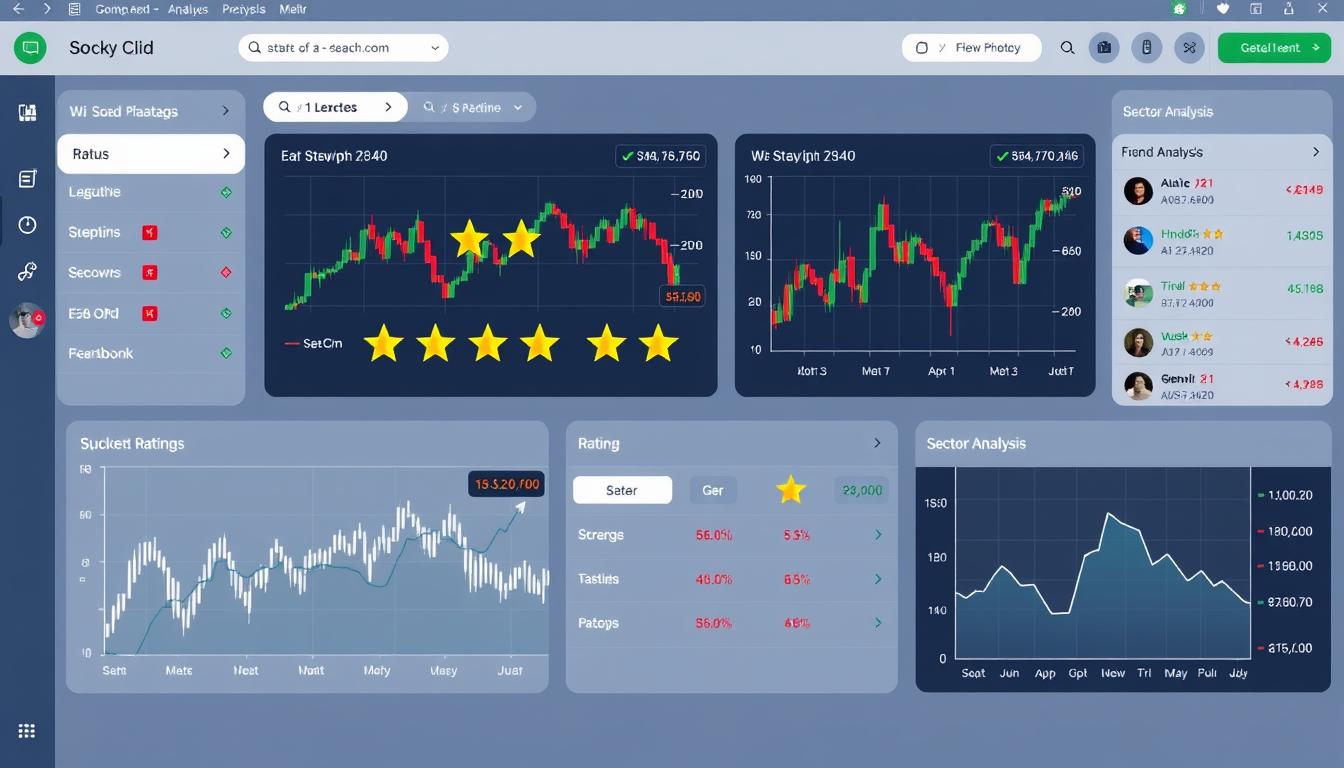

What Users Are Saying About 5starsstocks.com Stocks

“The five-star rating system has simplified my research process tremendously. I’ve discovered several overlooked mid-cap stocks that have performed exceptionally well.”

“I appreciate the sector-specific analysis, especially for dividend stocks. The platform helped me build a reliable income portfolio, though I always verify the recommendations independently.”

“The Smart Alerts feature has saved me countless hours of market monitoring. While not every alert leads to a winner, the time savings alone makes it worthwhile.”

5starsstocks.com Stocks serves a diverse community of investors with varying goals and strategies

Frequently Asked Questions About 5starsstocks.com Stocks

How accurate are the stock ratings on 5starsstocks.com?

The platform’s rating accuracy varies by sector and market conditions. According to internal data, 5-star rated stocks have shown approximately 78% positive performance over 6-month periods. However, as with any investment tool, past performance doesn’t guarantee future results. It’s recommended to use these ratings as part of a broader research strategy.

Is 5starsstocks.com suitable for complete beginners?

Yes, the platform’s intuitive interface and educational resources make it accessible for beginners. The star rating system simplifies complex analysis, though new investors should start with the educational content and focus on blue-chip stocks before exploring more speculative opportunities.

How does 5starsstocks.com compare to established platforms like Morningstar?

While Morningstar offers comprehensive fundamental analysis with a long track record, 5starsstocks.com differentiates itself with AI-driven insights, a more intuitive interface, and specialized sector analysis. Morningstar may be preferred for deep fundamental research, while 5starsstocks.com excels at identifying emerging opportunities and providing user-friendly analysis.

Can I use 5starsstocks.com for international stocks?

The platform primarily focuses on US markets, with limited coverage of major international stocks. Investors primarily interested in foreign markets may need to supplement with region-specific research tools.

Is 5starsstocks.com Stocks Right for You?

5starsstocks.com Stocks represents a significant evolution in how modern traders approach stock selection. Its AI-driven analysis, intuitive rating system, and comprehensive sector coverage offer valuable advantages for investors seeking to streamline their research process and discover new opportunities.

While the platform shouldn’t replace thorough due diligence or personalized investment strategies, it serves as a powerful tool for idea generation, preliminary screening, and market monitoring. The most successful users leverage 5starsstocks.com as part of a broader investment approach, combining its insights with additional research and personal judgment.

For investors struggling with information overload or looking to discover opportunities beyond familiar names, 5starsstocks.com Stocks offers a refreshing alternative to traditional research methods. Its modern approach to stock analysis aligns well with today’s fast-moving markets where timely insights can make all the difference.

5starsstocks.com Stocks empowers investors to make more informed decisions in today’s complex markets

Ready to Transform Your Stock Picking Strategy?

Experience how 5starsstocks.com Stocks can help you discover high-potential investments across multiple market sectors. Try the platform’s AI-powered analysis tools and see the difference for yourself.

Envie de parier 1xbet apk rdc est une plateforme de paris sportifs en ligne pour la Republique democratique du Congo. Football et autres sports, paris en direct et d’avant-match, cotes, resultats et statistiques. Presentation des fonctionnalites du service.

Experience Brainy https://askbrainy.com the free & open-source AI assistant. Get real-time web search, deep research, and voice message support directly on Telegram and the web. No subscriptions, just powerful answers.

сколько стоит кейс в кс 2 кс 2 кейсы

casino bets elonbet-casino-game.com/

Looking for a casino? elon casino top: slots, live casino, bonus offers, and tournaments. We cover the rules, wagering requirements, withdrawals, and account security. Please review the terms and conditions before playing.

Name Card – Your examples really helped me understand better.

комедії онлайн безкоштовно кримінальні серіали дивитися онлайн