MicroStrategy stock is drawing Wall Street attention as the company’s Bitcoin focus drives gains from 58% to 176% over the past year.

Key Takeaways

- MicroStrategy’s shift to focus on Bitcoin has affected its stock.

- MSTR has seen big gains, from 58% to 176% in the past year.

- The company’s investment strategy is now of great interest to investors.

- MSTR stock is seen as very polarizing on Wall Street.

- Investors are thinking about the risks and benefits of investing in MSTR.

Understanding MicroStrategy’s Business Evolution

MicroStrategy started as a leader in business intelligence. It has now changed its business model to include a big bitcoin strategy. This change is a big step in the company’s history.

Company Background and Core Software Business

MicroStrategy, now called Strategy Inc, began in business intelligence software. It has been a top name in data analytics and business intelligence solutions.

The Bitcoin Acquisition Strategy Shift

The company started investing in bitcoin as a strategic move. This move has become a key part of its financial plan. It was based on the chance for big returns in the cryptocurrency market.

Timeline of Major Bitcoin Purchases

MicroStrategy has bought bitcoin in several steps. The company has been open about its investment plans, sharing updates often.

- Initial purchase: [Date]

- Subsequent purchases: [Dates]

Current Bitcoin Holdings Value

As of the latest news, MicroStrategy has over 590,000 BTC. The value of this holding changes with the bitcoin market.

Recent Corporate Announcements

MicroStrategy keeps making news with its announcements. These show its dedication to its bitcoin strategy and software business.

MicroStrategy Stock Performance and Trends

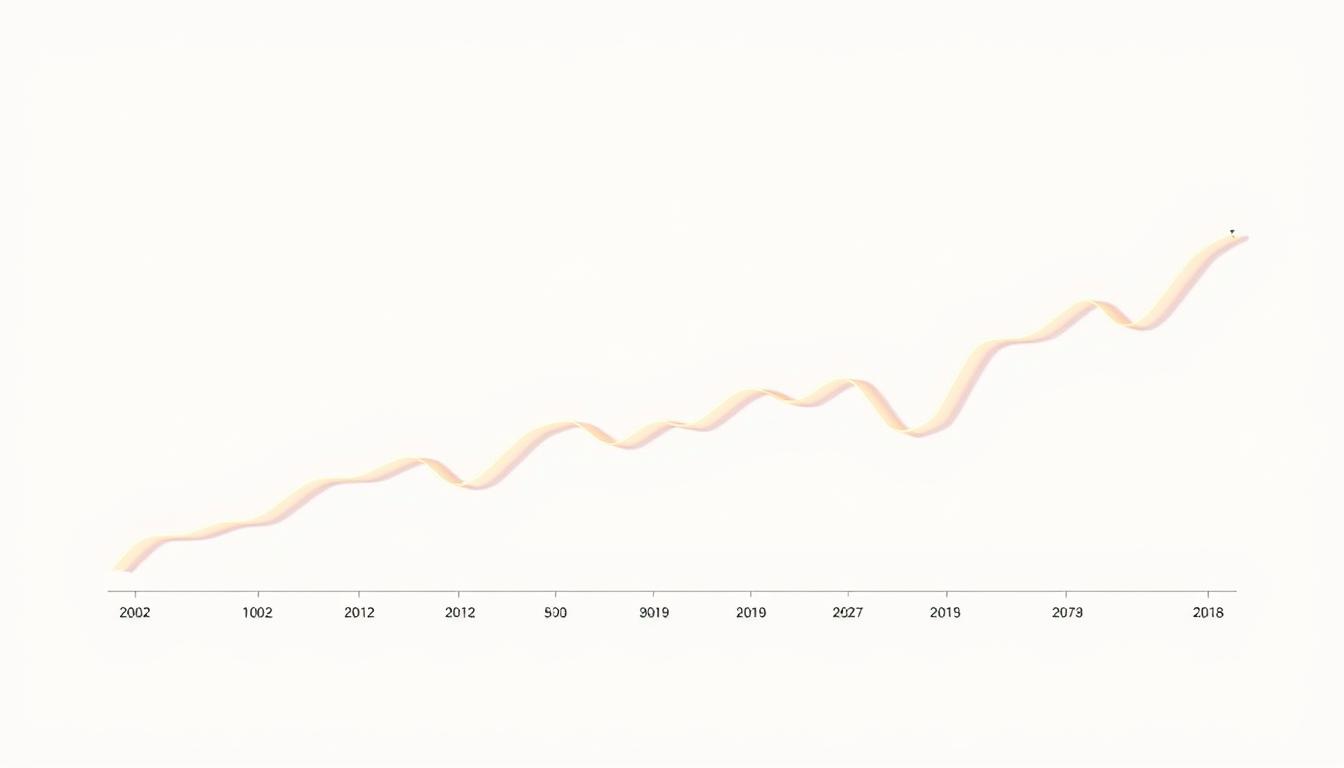

MicroStrategy’s stock has seen a lot of ups and downs, making it a big topic for investors and experts. By September 2, 2025, MicroStrategy (MSTR) was at $341.62, up from $300.11 at the start of the year. Its market value was around $97.3 billion.

Historical Stock Price Analysis

The history of MicroStrategy’s stock shows big changes. These changes were mainly because of its Bitcoin buys and the market’s mood.

Key Price Movements in 2023-2024

In 2023-2024, MSTR stock had big price changes. These changes were mostly because of the company’s bold Bitcoin buys and how the market reacted.

Volume Trends and Trading Patterns

Looking at volume trends and trading patterns helps us see what investors think and feel. When trading volumes are high, it means a lot of people are interested in the stock. This can lead to big price changes.

Comparative Performance Against Tech and Crypto Indexes

Comparing MicroStrategy’s stock to tech and crypto indexes gives us a better view of its place in the market. MSTR’s performance is linked to both tech and crypto, because it’s both a software company and a big Bitcoin owner.

As a financial analyst noted, “MicroStrategy’s stock is a special chance to see where tech and crypto meet, making it a unique investment.”

Technical Analysis Indicators

Technical analysis indicators are key to understanding MSTR’s stock trends. These include support and resistance levels, moving averages, and momentum indicators.

Support and Resistance Levels

Knowing support and resistance levels helps investors see where prices might stop. For MSTR, these levels have been key in shaping the stock’s price path.

Moving Averages and Momentum

Moving averages and momentum indicators give us clues about the stock’s trend and future moves. A rising moving average and positive momentum usually mean the trend is up.

“To do well with MSTR stock, you need to get the technical indicators and market trends,” a market expert advises.

How to buy MSTR stock on Public

It’s easy and simple to buy MicroStrategy (MSTR) stock on Public, even for first-timers. To start, get the Public app and make an account by giving personal information and proving who you are. Start by adding money to your account through a linked bank account. Then, use the search bar to find MSTR and see its current price, success charts, and key metrics. After that, you can put in either a market order or a limit order. A market order will buy at the current price, and a limit order will buy at a certain amount. Once you confirm the order, the shares will be added to your portfolio. From there, you can use the app to track performance, set alerts, and handle your investment.

While the company’s earnings and traditional software business success aren’t very impressive, the value of Bitcoin has a big impact on its finances, which can cause earnings to vary a lot from one quarter to the next. The next earnings report for Public Strategy is due around the beginning of February 2026. Different analysts are predicting different EPS outcomes that will give us more information about the company’s success trajectory.

Financial Health and Valuation Metrics

MicroStrategy (MSTR) is a unique trade because it is mostly a leveraged play on Bitcoin and not a normal software company. Its finances are in good shape, with a low cash-to-debt ratio and slow sales growth in its main business. However, valuation metrics suggest that the stock may be trading above what it’s really worth. Because the company depends so much on Bitcoin, its stock price changes a lot.

This means that buyers could make money when crypto markets go up, but they also run a big risk of losing a lot of money if crypto markets go down. So, MSTR might be good for investors who are willing to take risks and are bullish on Bitcoin, but it’s not as good for investors who want stable, fundamentally-driven stock investments.

Factors Driving MSTR’s Future Outlook

MicroStrategy’s move to buy more Bitcoin has changed its future outlook. The company is now in the cryptocurrency market. Several key factors will shape its future.

Bitcoin Price Correlation Analysis

The link between Bitcoin’s price and MicroStrategy’s stock is important. A strong link means MSTR’s stock price is closely tied to Bitcoin’s ups and downs.

Statistical Relationship Between BTC and MSTR

Studies show a strong link between Bitcoin and MicroStrategy stock prices. The correlation coefficient is high. This means MSTR’s performance is closely linked to Bitcoin’s price.

Looking at Bitcoin’s price can help predict MSTR’s future. If Bitcoin’s price goes up, MSTR might do well. But if Bitcoin’s price falls, MSTR’s stock could suffer.

Software Business Growth Prospects

MicroStrategy’s main business is software, not just Bitcoin. Its growth depends on innovation and attracting more customers.

Regulatory and Market Risks

MicroStrategy faces risks from regulations and market changes. These could affect its stock. Changes in Bitcoin rules or market mood could hurt MSTR’s stock.

Analyst Forecasts and Price Targets

Analysts have mixed views on MicroStrategy. A TipRanks survey shows a ‘strong buy’ rating. Trading Economics predicts the stock could hit $330.76, showing a positive outlook.

Conclusion: Evaluating MSTR as an Investment

Looking into MicroStrategy (MSTR) as an investment means understanding its growth, stock performance, and financial health. The company’s move to buy more bitcoin has greatly affected its stock price and market value.

When thinking about investing in MSTR, it’s key to consider your view on bitcoin and how much risk you’re willing to take. Your decision to invest in MSTR should reflect your honest thoughts on these points. This is because MSTR’s stock price often moves with bitcoin’s.

Investors can make a smart choice by looking at MSTR’s past stock prices, how it compares to tech and crypto indexes, and its valuation ratios. It’s also important to think about the growth of its software business, any regulatory risks, and what analysts predict. This helps figure out if the company could grow more in the future.

In the end, a detailed look at MSTR’s investment potential helps investors make a choice that fits their financial goals and risk level.