Managing your money well is key to financial stability. The envelope budgeting method is a classic budgeting system that helps you do just that. It works by sorting your spending into categories and putting cash into labeled envelopes for each one.

This budgeting system has been around for decades. It’s a simple yet powerful tool for managing your finances, helping you keep track of spending and make smarter money choices. It’s perfect for anyone who finds personal finance challenging.

Good money management is vital for reaching your financial goals. The envelope system makes it easy to follow a budget, avoid overspending, and gives you a clear plan for handling your money effectively.

Key Takeaways

- Envelope budgeting is a simple and effective financial management technique.

- It involves dividing expenses into categories and allocating cash into labeled envelopes.

- This approach helps individuals track their expenses and make conscious financial decisions.

- Envelope budgeting is particularlly useful for those who struggle with personal finance.

- It provides a clear and structured way to manage finances and achieve long-term financial goals.

What is the Envelope Budgeting System?

The envelope budgeting system is a simple way to manage money. It involves dividing expenses into categories. Then, you put cash for each category into separate envelopes.

This method has been around for a long time. It has evolved into digital versions to meet today’s financial needs.

The Origins and Philosophy

The envelope budgeting system started with using physical envelopes for expenses. It focuses on the realness of cash. This makes it easier to stay on budget by seeing the money for each expense.

Using cash limits spending because you can’t spend more than you have. It promotes careful spending and prevents overspending.

How It Differs From Other Budgeting Methods

The envelope system is different from digital budgeting. It offers a hands-on approach. It’s known for its simplicity and direct connection to cash.

Digital tools are convenient and track spending automatically. But, the envelope system provides a tangible experience. It’s great for those who like a more hands-on way to manage money.

The Science Behind This Effective Budgeting System

The envelope budgeting system works well because of its roots in psychology. It helps people manage their money better. By understanding how it affects our minds, we can see its true value.

The Psychology of Cash Spending

Cash is key to the envelope budgeting system’s success. Studies show that cash makes spending feel real and emotional. When we touch money, we think more about our spending.

This makes us more careful with our money. The pain of spending cash is stronger than digital payments. This is why the envelope system helps people stay on budget.

Statistical Evidence of Success

There’s solid proof that the envelope budgeting system works. People who use cash tend to spend less and reach their financial goals. For example, a study found it cuts down on unnecessary spending.

Here are some key stats:

- Many users say it improves their financial habits.

- It boosts saving for the future.

- It also helps reduce debt for many.

These numbers show the system’s power in teaching financial responsibility and reaching goals.

Benefits of Using the Envelope Budgeting System

Using the envelope budgeting system is a great way to control your spending. It helps you understand your finances better and make smarter choices.

Immediate Awareness of Spending Limits

The envelope system lets you know your spending limits right away. You put cash in different envelopes for different things. This way, you can see how much you can spend.

Reduced Overspending: The Numbers Don’t Lie

Studies prove that the envelope system cuts down on overspending. Using cash makes it easier to stay within your budget.

| Budgeting Method | Overspending Rate |

|---|---|

| Envelope Budgeting | 15% |

| Digital Budgeting | 30% |

Improved Financial Discipline

The envelope system helps you become more financially disciplined. Putting money in envelopes makes you think about where it goes. This helps you spend wisely.

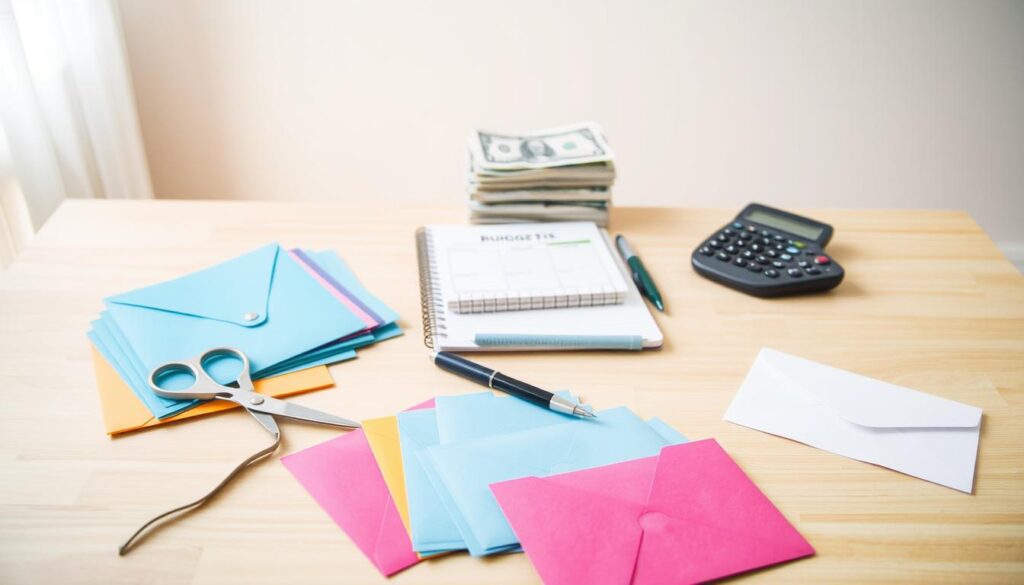

Getting Started: Essential Supplies and Preparation

To start your envelope budgeting journey, you must choose between physical and digital envelopes. This choice is key because it shapes how you handle your money every day.

Physical vs. Digital Envelopes

Physical envelopes are the traditional choice. They can be labeled and filled with cash for various expenses. This hands-on method is great for those who like handling cash and seeing their money go to different places.

Digital envelopes, on the other hand, are a modern twist. They use envelope budgeting tools and apps. These digital options make it easier to adjust your budget and are perfect for those who mostly use digital payments.

“The envelope system is a simple, effective way to manage your finances by dividing your expenses into categories.”

Tools and Resources Needed

Whether you pick physical or digital envelopes, you’ll need some basic budgeting resources. For physical envelopes, you’ll need envelopes, a printer for labels, and cash. For digital envelopes, you’ll need a good budgeting app or software that supports envelope budgeting.

Popular digital budgeting tools include apps that let you create virtual envelopes. They help you track your spending and set budget goals. These tools give you insights into your spending habits and keep you on track.

Step1: Analyzing Your Current Spending Patterns

Before starting with the envelope budgeting system, it’s key to understand your current finances. This first step is about knowing where your money goes. It’s essential for making smart budget choices.

Tracking Expenses for 30 Days

Start by tracking every transaction for 30 days. This includes small buys like coffee and big ones like rent. Use a notebook, spreadsheet, or budgeting app to record each expense. This will give you valuable insights into your spending.

“The key to understanding your financial situation is to track your expenses diligently,” says financial expert, Dave Ramsey. “This simple act can reveal a lot about your spending habits and help you make necessary adjustments.”

Identifying Your Spending Categories

After a month of tracking, sort your expenses into categories like groceries, transportation, and entertainment. This step is vital for seeing where your money goes and finding ways to save. Common categories include:

- Housing

- Food

- Transportation

- Entertainment

- Utilities

Finding Areas for Improvement

After sorting your expenses, look for areas to cut back. If you’re spending too much on dining out, try cooking at home more.

By following these steps, you’ll be ready to create a budget that fits your financial goals.

Step2: Creating Your Envelope Budgeting System

After looking at how you spend money, it’s time to set up your envelope budget. This step is key. It means making categories, figuring out how much to put in each, and dealing with unexpected costs.

Setting Up Your Categories

Creating categories is the base of your envelope budget. You need to find out where your money goes. Common spots include food, fun, travel, and bills. Make sure your categories fit your life and money needs.

“A well-structured budgeting system is not just about cutting costs, but about making conscious financial decisions that align with your goals.” – Financial Expert

Determining Allocation Amounts

Once you have your categories, decide how much to put in each envelope. Figure out how much of your income goes to each area. Be realistic and use your past spending as a guide. For example, if you usually spend $500 on food monthly, put that in your food envelope.

Handling Irregular Expenses

Dealing with unexpected costs, like car repairs or yearly subscriptions, can be tough. One way is to save a bit each month in a special envelope for these. This way, you’re ready when these costs come up.

By following these steps, you can make a good envelope budget. It helps you manage your money well.

Step3: Implementing and Maintaining Your System

Now that you have your envelope budgeting system set up, it’s time to put it into action. Making it work well is key to staying on top of your finances. This will help you get the most out of your budgeting efforts.

The Cash Withdrawal Process

To begin using your envelope system, you’ll need to take out cash for different areas of your life. First, figure out how much cash you need for each area based on your budget.

For example, if you’ve set aside $500 for groceries and $200 for eating out, you’ll need to take out $700. It’s important to keep track of this cash and make sure it goes into the right envelopes.

Example of Cash Withdrawal Allocation:

| Category | Allocated Amount |

|---|---|

| Groceries | $500 |

| Dining Out | $200 |

| Total | $700 |

Managing Digital Expenses in an Envelope System

In today’s world, many things are paid online. To handle these online payments with your envelope system, you can use digital envelopes. Or, you can set aside a part of your budget for online spending.

For things you pay for every month, like subscriptions or bills, put the money aside in a special envelope or account.

Adjusting Your System Over Time

As you keep using your envelope budgeting system, you might need to tweak it. This is because your spending habits and financial goals can change. Check your budget often and adjust it when needed.

If you find you’re spending more on eating out than planned, you might need to change your budget for that area. Or, you could be stricter with how much you spend there.

By following these steps and keeping up with your envelope budgeting system, you’ll be able to manage your money better. This will help you reach your financial goals.

Common Challenges and How to Overcome Them

The Envelope Budgeting System works well, but it faces some common obstacles. These include running out of money in certain categories, dealing with unexpected costs, and staying motivated.

When You Run Out of Money in an Envelope

It can be tough when you use up all the money in an envelope. A good solution is to reallocate funds from another area. For example, if you’ve spent too much on dining out, cut back on entertainment for the month.

Handling Unexpected Expenses

Unexpected costs are a fact of life. To handle them, keep an emergency envelope in your budget. This envelope should have money set aside for sudden expenses, so you don’t have to use money meant for other things.

Staying Motivated with Visual Progress Tracking

Seeing your progress can really help keep you motivated. Use a budgeting app or spreadsheet that shows your progress. Seeing how far you’ve come can keep you on track with your budget.

Knowing these challenges and how to tackle them can help your Envelope Budgeting System succeed in the long run.

Conclusion: Taking Control of Your Finances

Effective budgeting leads to greater financial control and stability. The Envelope Budgeting System helps individuals understand their spending habits. It allows them to make conscious financial decisions.

The Envelope Budgeting System reduces overspending and improves financial discipline. It lets people allocate funds into specific categories. This way, they stay within their means and work towards their financial goals.

By using the Envelope Budgeting System, you can secure a stable financial future. It offers a simple and effective way to manage money. This way, you can make the most of your hard-earned cash.

Remember, budgeting is an ongoing process, not a one-time task. With the Envelope Budgeting System, you can keep financial control. You can also make adjustments as needed to stay on track.